Summary

Learn how our son uses his Coverdell ESA to invest in real estate backed notes at the ripe old age of 12-months, and is leveraging The Rule of 72 to grow his Coverdell ESA as fast and securely as possible. As a parent, explore your best options for helping your children tackle the monster known as college tuition.

Happiest Day of Our Lives

On August 16th, 2016 my wife and I were blessed with our first child, a healthy baby boy. It was the happiest day of our lives when our son was born, he is an amazing little guy who continues to challenge me, ground me, and give me the perspective of how to take the time to enjoy life to the fullest. Like anyone of you with kids, you know that life is never the same after having them. Our friends and family always said, “things will never be the same after you have kids”, but you don’t really get the true meaning of that saying until you are deep in the throes of cleaning up a diaper blowout, or pacing up and down in the middle of the night to try to calm a teething baby.

Change in Priorities

For me there was a mindset change when my son was born. Along with the joys of fatherhood came the weight of responsibility to do my best to set him up for long-term success. One of my priorities was to set up an educational fund to help my son pay for college. When I was a baby, my grandfather setup a college annuity plan for me, which I used to pay for the majority of my college tuition. I want to set my son up in the same way that my grandfather did for me over 3-decades ago. So first things first, how much money will you need in the future to pay for college?

Growing Cost of Education

After going through numerous sites, trying to find the best evaluation and forecast of current tuition costs as well as future tuition costs, I found a solid resource at www.collegeboard.org. From their about page on their site:

“The College Board is a mission-driven not-for-profit organization that connects students to college success and opportunity. Founded in 1900, the College Board was created to expand access to higher education. Today, the membership association is made up of over 6,000 of the world’s leading educational institutions and is dedicated to promoting excellence and equity in education.”

There are some great resources on the site, what I was drawn to were a few detailed charts mapping the trends in pricing for college tuition from the late 1980’s to 2018.

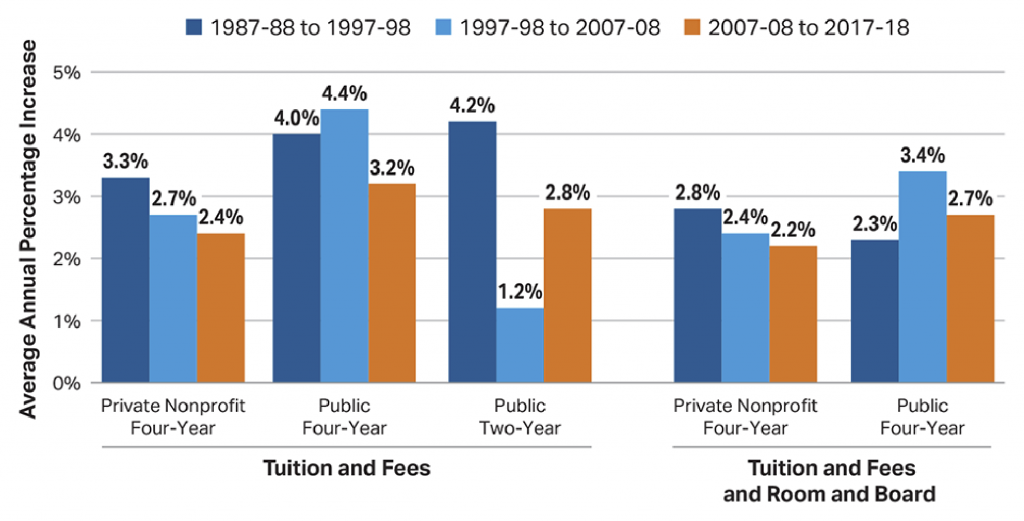

Average Rates of Growth of Published Charges by Decade:

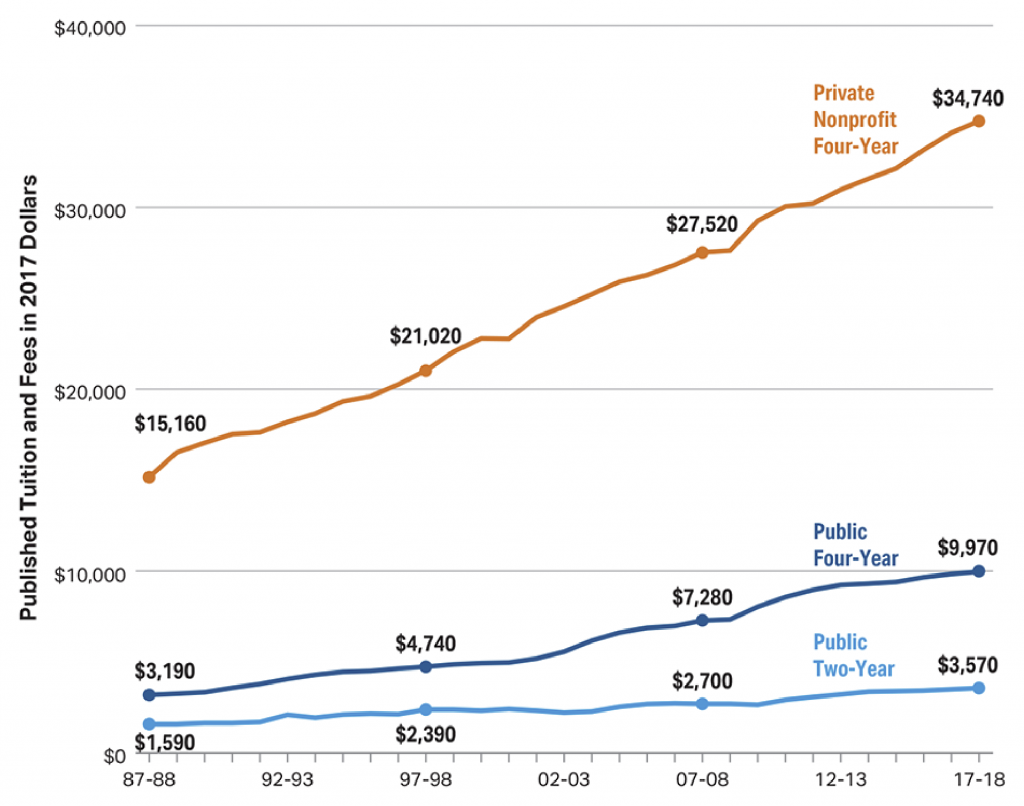

Tuition and Fees and Room and Board over Time:

Key Takeaways from CollegeBoard Charts:

Key takeaways are being pulled from the largest data segment, that of Public 4-Year In-State Undergraduate Programs. For additional takeaways on other data segments such as Private 4-Year Out-of-State Undergraduate Programs, refer to the above charts sourced from www.collegeboard.org.

Public 4-Year In-State Undergraduate Colleges, Tuition and Fees from 2007 to 2018 have grown the least (2.8%) compared to previous 10-year periods. This can be viewed as a welcome sign of easing prices increases, however we’re still looking at a 10-year increase in Tuition and Fees of 32%. At current rates, that means that when my son goes to college, the cost of tuition and fees will have increased by an alarming 54.4%!

Drilling down a litter further, the total yearly undergraduate budget for Public 4-Year In-State is estimated to be $20,700. That includes tuition, fees, room and board. Making a quick projection using the historical growth rate of 2.7%, in 17-years when my son goes to college he will be staring at yearly bill of $30,000. That amounts to over $120,000 for 4-years of college, and this doesn’t include the cost for books, transportation and other expenses.

Now I’m not accounting for the cost of inflation in these calculations, we’re just using the current value of a dollar in these projections.

Factors to Consider for College Fund

There were several factors that I wanted in a college tuition fund, which really turned into a non-negotiable check list of my requirements. After putting together this non-negotiable list, I was able to easily determine the college tuition investment vehicle to use. If you are planning to help your children pay for college, take a minute to figure out your non-negotiable list. The factors most important to me were:

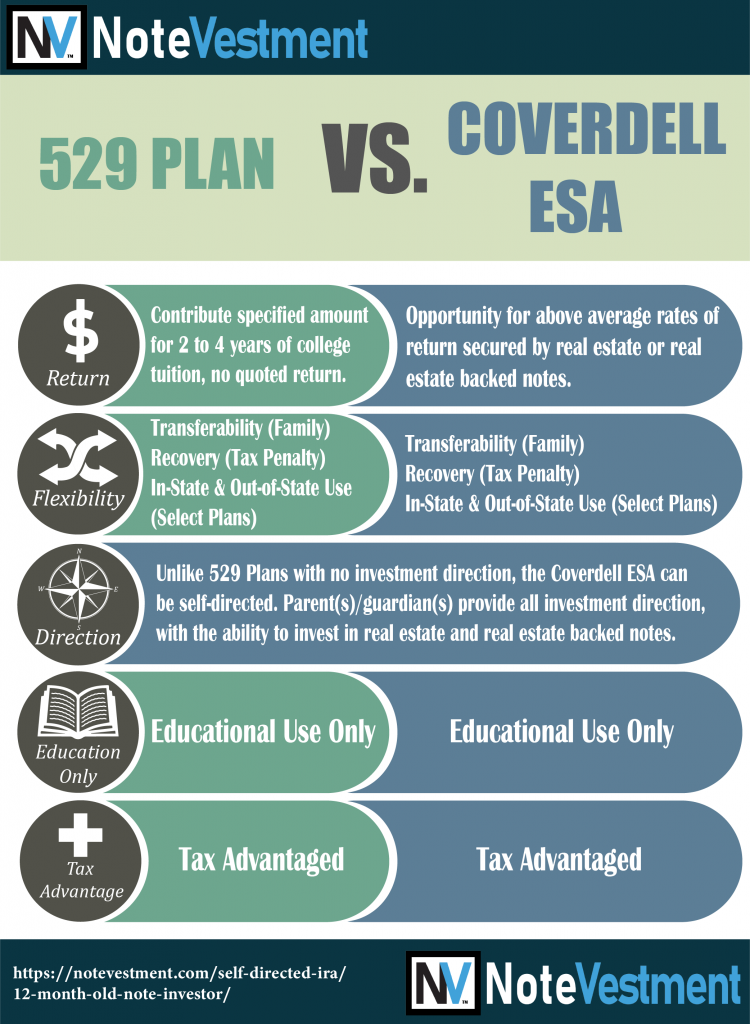

- Rate of Return – Provide a secure, above-average return to support the future cost of tuition

- Flexibility – Offer transferability, recovery, and use for in-state or out-of-state colleges

- Direction – Offer personal direction of investment, specifically real estate investment

- Educational Use Only – Restrict to educational purposes only

- Tax Advantaged – Minimize taxes to maximize returns

Options to Fund My Child’s College Education

Now that we have our non-negotiable list, lets take a look at the top 2 options that are out there for funding college tuition, and see which option made it to the top of my list.

529 Plan

The U.S. Securities and Exchange Commission most appropriately defined 529 Plans as:

You will find a wide-ranging set of 529 Plans offered throughout the country, with many similar characteristics and other differentiators such as in-state or out-of-state applications, or more affordable fee schedules. The basic premise behind the 529 Plan is that you contribute a set amount a set number of years before your child attends college, and in return you receive 2 to 4 years of college tuition. Some people refer to 529 Plans as prepaid college tuition plans in which you pay at current rates for college tuition that will be reimbursed in the future.

Coverdell Educational Savings Account (ESA)

Formerly known as an Education Individual Retirement Account (IRA), the Coverdell ESA was first introduced in the Tax Payer Relief Act of 1997. The plan is named after Senator Paul Coverdell of Georgia. Many of the Coverdell ESA’s characteristics mirror those of the 529 Plan, but with a few key differences.

The first of which is that qualified education expenses for Coverdell ESAs include college tuition as well as primary and secondary school. This means that Coverdell ESAs can be used to fund private school to include books and supplies necessary for public school. The second differentiator is that the Coverdell ESA can be converted to a self-directed Coverdell ESA, which can then be used to invest in alternative assets such as real estate or real estate backed notes.

As a practical example of the power of the Coverdell ESA, it can be used to wholesale real estate contracts or to purchase performing real estate backed notes.

Comparison of the 529 Plan and the Coverdell ESA

The 12-Month Old Note Investor Starts His Career

After reviewing my options, it was a clear choice that I would be opening up a Coverdell ESA account for my son, simply due to the fact that I could provide investment direction and invest in real estate and real estate backed funds. Personally, I would rather be able to make investment decisions for his account, rather than pay into a 529 Plan as a prepaid college tuition plan. I believe that through continued diligence and self-direction his Coverdell ESA will easily outperform any state offered 529 Plan.

When my son was around 8-months old his Coverdell ESA was opened at a self-directed IRA custodian, in order to take advantage of the ability to self-manage his ESA. After several months I located a performing real estate backed note, which we were able to purchase along with my self-directed Roth IRA. The note purchase closed when he was 12-months old! The beauty of the deal is that the note is secured by real estate with equity and is earning us ~ 11% annualized return.

The Rule of 72

The Rule of 72 was one of the first principles that I was taught when I was studying finance at Virginia Tech University. The Rule of 72 is a quick and easy way to determine how long it will take for an investment to double based on the current annual rate of interest. Divide 72 by your annual return to come up with the amount of time, in years, that it will take to double your money.

Example:

A real estate backed note earns an annualized return of 12%, how long will it take to double? 72 / 12 = 6 years

Lets apply this scenario to my son’s Coverdell ESA and it’s performing real estate backed note that is earning 11% annualized return. This means that in ~ 6.5 years the money will double. The contribution limit for a Coverdell ESA is currently $2,000/year, which is significantly lower compared to a 529 Plan. However the beauty is in the concept of compounding and interest over time, because this $2,000 investment at 12-months old will double ~ 2.6 times by the time he begins college.

Year 0: $2,000

Year 6.5: $4,000

Year 13: $8,000

Year 18: $16,000

So a simple goal for my son’s Coverdell ESA is to continue to invest the $2,000/year towards performing real estate backed notes, which if done for 5-years in a row, will equate to a windfall by the time he starts college. With an 11% annualized return, my son will have approximately $18,000 to pay for his college tuition each year. This is with an initial investment of $10,000 over the course of 5-years.

I recommend using The Rule of 72 for all types of investments to check to see how quickly your investment will deliver a 100% return on principal. A key point to note is that The Rule of 72 assumes that the funds are continually being re-invested and that they are earning the same rate of return. That is why we’re using this rule as a quick gauge on our investment returns.

Closing Thoughts

I hope that you found some beneficial information in this post to help you consider your options for helping your kids pay for their future college tuition. Obviously there is a lot to consider, but the sooner you get started the sooner you can start leveraging your money to work for you.

If you have questions or would like to get more information on Coverdell ESAs, shoot us an e-mail at wade@notevestment.com. If you want to learn the basics about what real estate note investing is click here. Please comment on this post and let us know your thoughts.

Thanks for reading!