Note Investing with Dodd Frank

What does note investing with Dodd Frank mean? For those of you that are newer to the real estate note investing and real estate investing as a whole, Dodd Frank is not a real estate guru or the best thing since sliced bread. Dodd Frank, formally known as The Dodd–Frank Wall Street Reform and Consumer Protection Act, was signed into law by Barack Obama back in 2010 as a response to the Great Recession of 2007.

The 2,300 page legislation was written by former Congressman Barney Frank and former Connecticut Senator Chris Dodd was intended to regulate financial markets, protect consumers and do as much as possible to prevent a repeat of the Great Recession. A product of the Dodd Frank Act was the establishment of the Consumer Financial Protection Bureau (CFPB), which was created with the basic intent to protect consumers and promote transparency with anything related to mortgages and credit cards. This means that when you are note investing, you are note investing with Dodd Frank and all of the red tape that goes with the legislation.

Quick Overview of Implications of Dodd Frank

As a real estate note investor, you may be held liable for Dodd Frank non-compliance on a note that you did not originate. Yes, it is true for any note originated after January 1, 2014. The Dodd Frank Act applies to seller financed notes that are originated to borrowers who are using the collateral property as their primary residence. This means that properties used for investment, not primary residences, are not subject to Dodd Frank regulations.

News Flash CFPB Ruled Unconstitutional..Again

Court Decision

In June 2018, the CFPB was ruled unconstitutional for a second time, the first being back in October 2016. Specifically in the summer of 2018, U.S. District Judge Loretta Preska of the New York Southern District declared the CFPB to be unconstitutionally structured. You can read more specifics about the case in housingwire.com’s full article.

Implications

What does this mean for real estate investors? Specifically how will this play out for real estate note investing with Dodd Frank? This is yet to be determined as case law continues to build against the CFPB. However, with numerous judges ruling the CFPB unconstitutional, this may call into question the 2,300 page Dodd Frank Act. Only time will tell.

Currently How Are Note Investors Affected?

Note investing with Dodd Frank is the new normal across the country. So long as the Dodd Frank Act remains as part of our legislation, we must work within the constraints of the law. To summarize, note investors are going to be affected in following ways:

- Persons, Trusts or Estates: Must comply with Dodd Frank requirements in the origination of more than 1 note to an owner occupant using the property as their primary residence.

- Legal Entities (e.g. LLCs, Corporations): Must comply with Dodd Frank requirements in the origination of any notes to owner occupants who use the property as their primary residence.

- The purchase of notes originated after January 1, 2014 must be Dodd Frank compliant.

I’m Not Originating Notes, Why Should I Care?

Even if you are not originating notes, don’t discount the Dodd Frank legislation. You could be held liable if you purchase a note that is not Dodd Frank compliant. That is right, you could be held liable for the mistakes made by the loan originator.

Currently How Are Note Investors Not Affected?

Luckily, Dodd Frank does not apply in specific situations relating to seller financing/owner financing. Generally, note investors are not affected by Dodd Frank in the following situations:

- Notes originated before January 1, 2014.

- Notes originated to buyers that are legal entities (e.g. LLCs, Corporations, Partnerships).

- Notes originated on commercial property, land, or multi-family units (+4 units).

- Notes originated on investment properties, not used as primary residences.

Breaking Down Dodd Frank Note Origination Requirements

Now that we’ve identified if you fall under the Dodd Frank regulations, let’s talk about what those requirements look like. There are several requirements mandated when note investing with Dodd Frank. The requirements build on top of each other as you originate more seller financed notes throughout the year. So what are the Dodd Frank requirements?

Note Investing with Dodd Frank – Requirements

#1. Interest Rate

- Seller financed note must be indexed to a publicly available rate (e.g. 3-year treasury bill)

- Interest rate must be fixed for 5-years, before resetting

- Interest rate can increase up to 2 points per year

- Interest rate cannot exceed 6 points from its origination rate

#2. Balloon Payment

- Seller financed note cannot have a balloon payment

#3. Determine Ability-to-Repay

- Reasonable and good faith determination has been made by the loan originator with regards to the borrower’s ability-to-repay

- Ability-to-repay requirements were not elaborated on in Dodd Frank legislation

- Compliance will evolve as case law builds from future litigation

The statutory ability-to-repay standards reflect Congress’s belief that certain lending practices (such as low- or no-documentation loans or underwriting loans without regard to principal repayment) led to consumers having mortgages they could not afford, resulting in high default and foreclosure rates. Accordingly, new TILA section 129C generally prohibits a creditor from making a residential mortgage loan unless the creditor makes a reasonable and good faith determination, based on verified and documented information, that the consumer has a reasonable ability to repay the loan according to its terms.

The Federal Register

#4. Registered Mortgage Loan Originator (RMLO)

- The seller financed note must be originated by a licensed RMLO

- Up to 3 seller financed notes = No, RMLO requirement

- 4+ seller financed notes = Yes, RMLO requirement

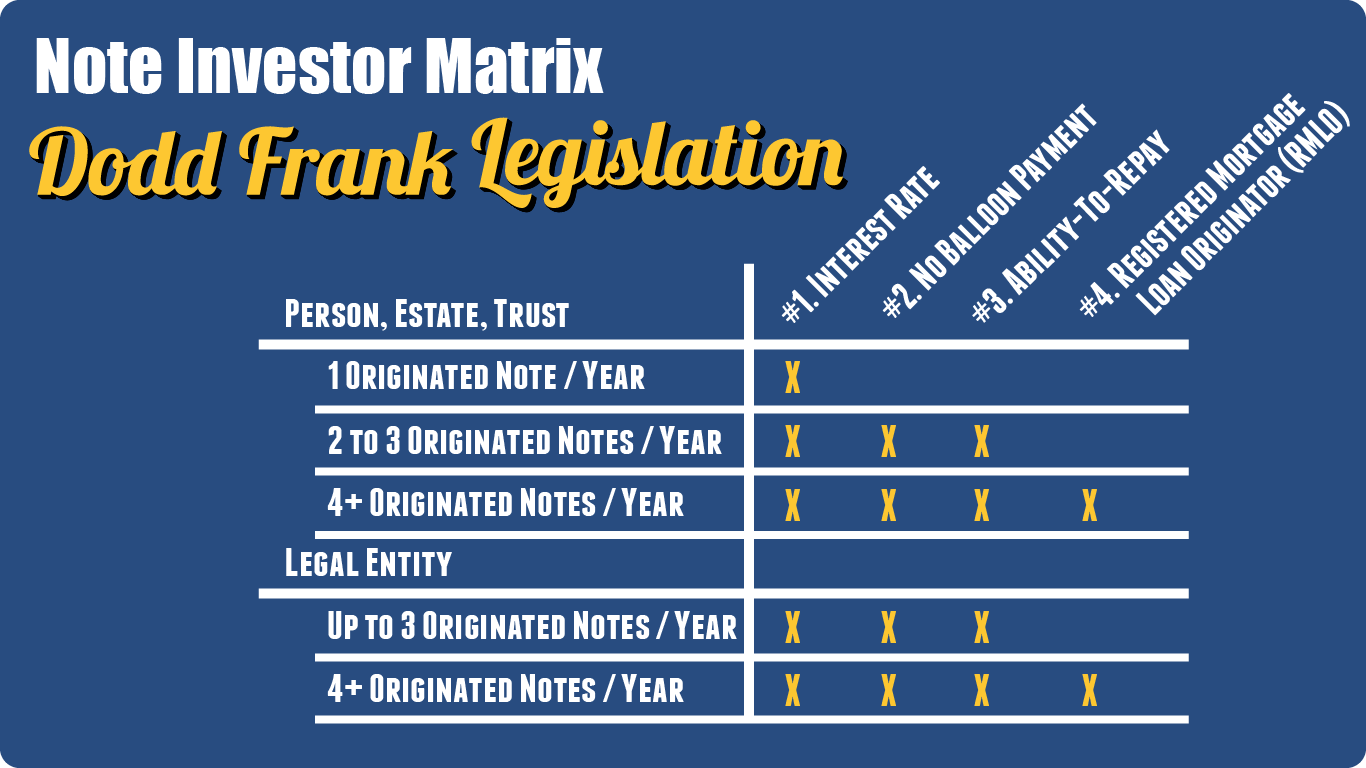

Real Estate Note Investor Matrix for Dodd Frank Legislation

The matrix below is a easy visual that can be leveraged to quickly determine where you fall as a note investor who is originating seller financed notes.

As highlighted in the matrix above, if a note originator falls within the basic Dodd Frank regulations noted above, then there are 3 main categories, or levels, of Dodd Frank compliance. These categories, or levels, can be broken down into 3 main sets:

Requirement Set #1

Applies to Persons, Estates or Trusts that are creating only 1 seller financed note a year.

- Interest rate requirement only

- No other Dodd Frank requirements outlined above apply

Requirement Set #2

Applies to Persons, Estates or Trusts that are creating between 2 to 3 seller financed notes per year. Additionally applies to legal entities (e.g. LLC’s, Corporations) that are creating up to 3 seller financed notes per year.

- Interest rate requirement

- No balloon payment permitted

- Ability-to-repay requirement

Requirement Set #3

Applies to Persons, Estates or Trusts and legal entities that are creating more than 3 seller financed notes per year.

- Interest rate requirement

- No balloon payment permitted

- Ability-to-repay requirement

- RMLO requirement

How Dodd Frank Works When Purchasing Real Estate Notes?

If you are purchasing a note that was originated after January 1, 2014, then you are note investing with Dodd Frank. Consider the following points when performing your note investing due diligence:

- Was the loan originated to borrower who would be occupying the home as his/her primary residence?

- Was the loan originated by a large financial institution?

- Due to extensive financial regulations, the note was more than likely originated under full Dodd Frank compliance

- Was a RMLO used during origination?

- Does the loan have a balloon payment?

- Does the loan have a fixed interest rate that prescribes to the requirements outlined above?

- Did the loan originator determine the buyer’s ability-to-repay?

If you are purchasing directly from the loan originator, ask for them to supply an affidavit attesting that they haven’t originated more than 3 seller financed notes in the last 12-months. If you aren’t purchasing from the loan originator, then review the terms of the note, taking the points stated above into consideration. For example, if the loan has a balloon payment, the note seller needs to modify the note and remove the balloon payment.

Closing Thoughts

Note investing with Dodd Frank takes some getting used to for investors, but you can continue to build a successful note investing business while being totally Dodd Frank compliant.

For those of you that are interested in reading the complete Dodd-Frank Wall Street Reform and Consumer Protection Act, you can visit the U.S. Government Publishing Office here to read all about it. Getting any further into Dodd-Frank is beyond the scope of this post.

If you want to read more about real estate note investing go to NoteVestment.com’s blog page. Or if you are looking for some educational resource, you can check out our real estate note investing book recommendations.

As always thanks for reading!

Disclosure Statement:

This article, also called a blog post, contains pertinent information and resource links to legal information, or information that may be construed as legal information, or guidance, aimed at helping the readers of NoteVestment.com with any number of aspects of real estate note investing. While I spend countless hours researching and sourcing the latest information pertaining to this article, or blog post, know that federal and state statutes are subject to change at anytime after the publication of this article, or blog post. I am not a licensed attorney and all information in this post should not be seen as legal advice. You should consult with a licensed attorney to obtain professional legal advice and perform your own due diligence before acting upon any of the information provided in this article, or blog post.