Ultimate Guide to Note Investing Due Diligence

We’re covering note investing due diligence in Part 2 of The Basics Series. This is The Ultimate Guide to Note Investing Due Diligence, and we aim to please. Not only is this post jam packed with content, but we’re going the extra mile and providing you with advanced due diligence tips that can make the difference between making or losing money as a note investor.

Throughout The Basics Series, offered exclusively at NoteVestment.com, we’re hitting on the foundational concepts of real estate note investing to help new note investors get started. Just in case you missed Part 1 of The Basics series, What is Real Estate Note Investing?, you can read it here. Now, lets jump into The Ultimate Guide to Note Investing Due Diligence!

Update: February 21, 2021

As NoteVestment.com continues to mature, we’ll continue to work on updating our content as we continue investing in real estate notes. To that point, quick update here with something that we experienced on a real estate note in Ohio (OH), which was initially clouding title to the property!

We had performed a Deed in Lieu (DIL) of Foreclosure on a property, and were looking to sell the property to a local investor so that we could cash out of our initial investment on the real estate note that we had initially purchased. We hit a snag and potential cloud in the property’s title when we found out that Ohio (OH) has a dower clause for property. So what does this mean?

Dower Clause

When I hear about dower or dowry, I think of the traditional custom that dated back into colonial times, in which a bride-to-be brought her husband-to-be property and/or money in order to marry. The opposite of this was curtsy, where a husband-to-be did the reverse, giving property and/or money to a bride-to-be’s family.

What we discovered is that Ohio (OH), Arkansas (AR) and Kentucky (KY) still uphold dower rights under a dower clause, which I had never heard any other note investors talk about before. Let’s illustrate dower rights in an example:

John, who is married to Susan, sells his property, located in Columbus, OH, to Adam for $250,000. Along with the signed deed, Susan must sign a release of dower rights in order for the property to be transferred without encumbrances (clean title). If she does not sign a release when the property is sold, and no one catches it before closing, the property now has a clouded title. Five (5) years later, Adam decides to sell the property, however his title company discovers that the title is clouded because these dower rights were not released by Susan. Susan must sign the release in order to clear the title on the property. If Susan can’t be found, then a quiet title action will need to be performed to clear the title on the property.

Death and divorce are the only ways to terminate dower rights, which ended up being the silver lining in our situation. The previous owner had gone through a divorce, so we were able to sell the property with a clean title.

Recommendation:

For notes that you’re purchasing in OH, AR or KY, take extra time to review the chain of title to ensure that all assignments have corresponding releases of all dower rights from spouses (signed, notarized and ideally recorded). If a borrower divorced prior to selling a property, make sure to review the divorce paperwork checking that the divorce occurred before any property sale.

You Make Money On The Buy

The common real estate adage holds true just as much with self-storage investing as it does with real estate note investing. You make your money on the buy, not on the sell. While this adage may be as commonplace as the phrase location, location, location when purchasing real estate, it holds true to real estate note investing.

When performing note investing due diligence, you want to set yourself up for the greatest potential profits at your exit. For that reason a large portion of due diligence comes down to eliminating potential risks and mitigating those risks that cannot be completely eliminated in an investment.

Note Due Diligence Subject to Change

Note investing due diligence varies based on the underlying collateral, or the type of real estate that the note is attached to. For example your due diligence will change if the underlying collateral is vacant land, commercial property, or residential single-family homes. This may seem like an obvious observation, but it’s an important data point to address regarding note investing due diligence.

In contrast to commercial notes or notes on vacant land, residential backed real estate notes are the most commonly traded real estate backed notes. For that reason, for the purposes of this post, we will be focusing on note due diligence on residential real estate backed notes.

Phases of Note Investing Due Diligence

Note investing due diligence is broken up into 2 main phases, initial and secondary due diligence. The first initial due diligence phase is performed before submitting initial bids to note sellers. Once an initial bid is accepted, you move into the secondary due diligence phase. Before we talk about each phase of due diligence below, let’s cover basic note purchasing terminology.

Note Purchasing Terminology

To level-set everyone’s understanding, here are a few terms that relate specifically to purchasing real estate backed notes:

- Unpaid Principal Balance (UPB): The amount of principal owed on a note.

- Total Arrearages: The total amount owed on a note, including UPB, missed payments, late fees and legal fees.

- Tape: A real estate note seller’s list of notes for sale. Tapes have relevant information relating to each note, which note buyers use to work through their note investing due diligence process (e.g. borrower information, property address, occupancy status, UPB, last paid date, note origination date).

- Fade: The act of reducing your initial bid price as a result of new information discovered during secondary due diligence (e.g. $5,000 in code enforcement violations).

- Note Pool: A group of notes.

Phase 1: Initial Due Diligence

Initial note investing due diligence will vary from one real estate investor to the next. For example, one note investor will hit on a few critical elements to their due diligence before submitting initial bids. On the other side, a newer investor may cover a wide range of due diligence pieces in this initial phase before submitting an initial bid. This comes down to your level of experience and comfort with submitting bids without knowing all pieces of due diligence on the front end. As you become more familiar with analyzing real estate note deals you will start to build efficiencies in your due diligence. Don’t get frustrated if you feel like initial due diligence is taking you too long when you first start out, things will get easier. Additionally, your purchasing criteria will narrow as you continue to purchase notes.

Basic Elements of Initial Due Diligence

Basic elements of note investing due diligence include:

- First strip out any of the states that you are not looking to invest in.

- Second, filter out any of the cities that don’t pass your criteria (e.g. low population, high vacancy rate, negative growth rate).

- Third, strip out any of the properties that do not meet your minimum criteria (e.g. built before 1950, less than 3 beds).

- Fourth, strip out any notes that don’t meet your overall strategy (e.g. payment history, UPB).

- Fifth, perform any additional due diligence steps based on your comfort level.

Phase 2: Secondary Due Diligence

In the secondary stage of note investing due diligence you will perform all of the detailed, thorough note analysis. Your secondary due diligence should either confirm the initial bid price that you made, or give you pause to consider a fade of your initial bid. More often than not, you will uncover aspects of the prospective note you are looking to purchase that will warrant a fade of your initial bid.

This is due to the fact that many important due diligence items like collateral review or Owner & Encumbrance (O&E) Report review are not performed during initial due diligence. Which is why the secondary due diligence phase is so important when purchasing real estate backed notes. Let’s talk about your note investing due diligence strategy now.

Due Diligence Strategy

A key point to remember with purchasing notes is that after your initial bid is accepted, you will have a period of time to perform your secondary note investing due diligence. Once this secondary due diligence phase ends the transaction is funded. For single note purchases, note sellers usually offer around 7-days to perform secondary due diligence. For larger acquisitions of note pools, secondary due diligence can extend well past 30-days.

Strike When the Iron is Hot

An effective strategy is to quickly perform initial due diligence and be one of the first to submit your bid on multiple assets. There are multiple benefits to this strategy, to include:

- Note sellers receive your initial bids first

- Bulk purchases translate to larger discounts at the time of acquisition

- An accepted bid ties assets up, giving you time to perform secondary due diligence

- The note seller won’t accept all of your bids on every asset, so you have a better chance of purchasing notes

- Multiple assets means a longer secondary due diligence period

To summarize, there are many benefits to quickly submitting an initial bid on multiple assets. That being said it is easier said than done to submit a large bid on multiple assets at once. Don’t stretch too far when starting out, but remember that the majority of your bids won’t be accepted by note sellers. Better to submit a bid on 10 assets and get 3 accepted offers than lose out on all of the assets.

How to Eat The Due Diligence Elephant?

One bite at a time and with some helping hands!

Note investing due diligence is incredibly important, but it can also feel like one of the most daunting tasks of note investing. There are many different pieces of due diligence, all that should be accounted for in order to ensure that you are in the best position at the time of note acquisition. For that reason I highly recommend that you leverage the services of professionals such as attorneys and title review companies such as ProTitle USA, who can assist you with note investing due diligence.

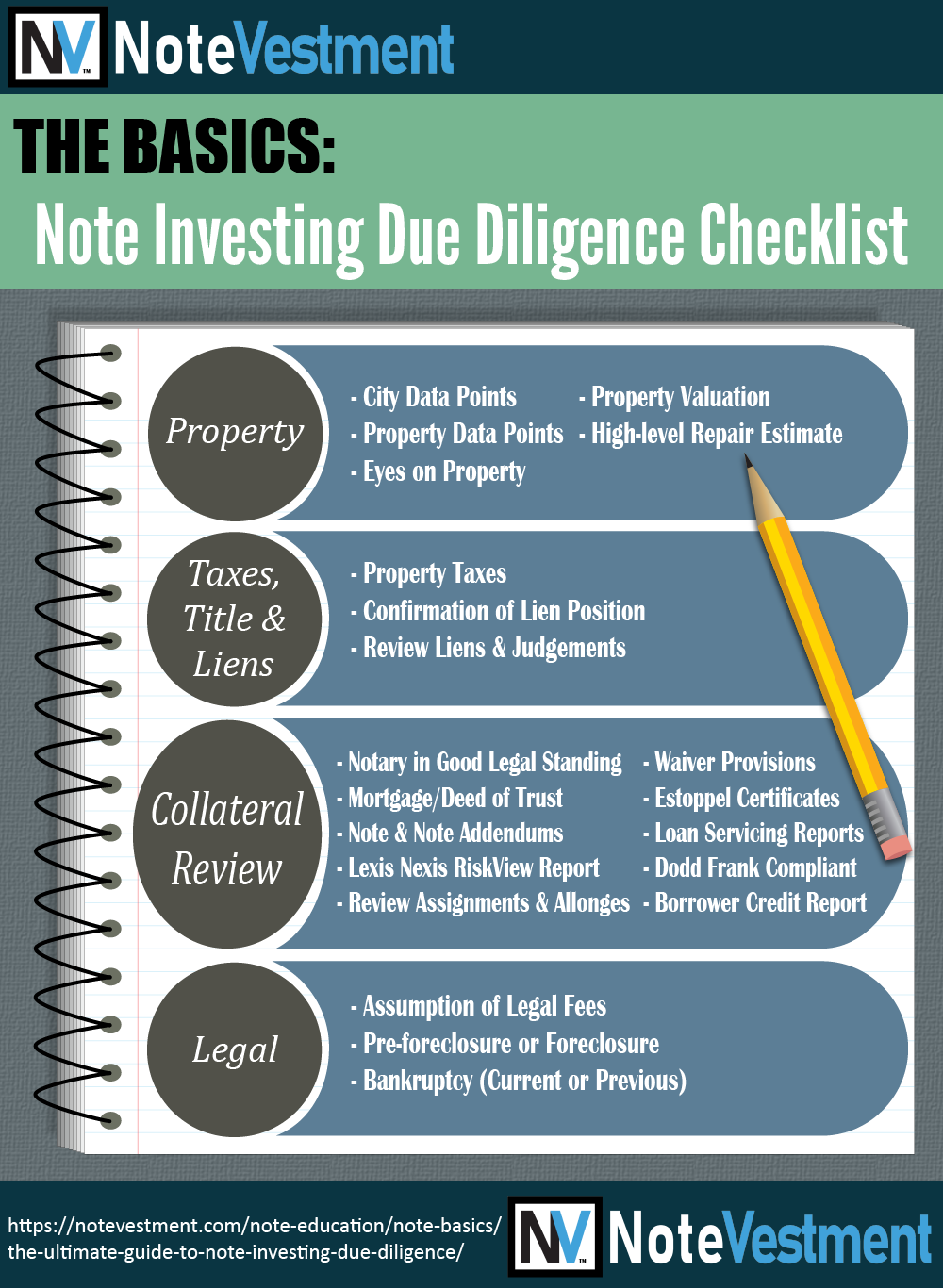

Quick Due Diligence List Checklist

- Property

- City Data Points

- Property Data Points

- HOA/COA

- Eyes on Property

- Valuation of Property (BPO, CMA, online comps)

- High-level Estimate of Repairs

- Taxes, Title and Liens

- Property taxes

- Last person to pay taxes

- Mailing address on file for property tax bills (determine occupancy)

- Tax deed/lien certificates

- Confirm lien position of note

- Review all liens/judgements on O&E Report

- Review recording dates of liens/judgements

- Water, sewer and utility liens

- Check for disconnected/shutoff utilities (vacant property)

- HOA/COA Lien

- Superior Lien State (check with this free resource)

- County code enforcement violations and fines

- Property taxes

- Collateral Review

- Notary in good standing (active license) on all collateral files signed by mortgagor and mortgagee

- Mortgage/Deed of Trust

- Fee simple

- Due on Sale Clause

- Language on Lender Recourse Provisions

- Signed by Borrower

- Language Requiring Insurance on Property

- Language Requiring Borrower to Pay Taxes Accrued and Due

- Late Charge Provisions

- Foreclosure Procedures

- Accurate Legal Description with Property Lot and Block

- Note and Note Addendums

- Existence of original note

- If not require Loan Loss Affidavit

- Note Terms (e.g. Total Amount, Payment Amount, Origination Date, Maturity Date, Loan Term/Length, Interest Rate Before Default, Interest Rate After Default)

- Borrower’s Address

- Lender’s Address

- How payments will be applied?

- Late payment provisions

- Usury Savings Clause

- Existence of original note

- Waiver Provisions

- Notice

- Demand

- Notice of Intent to Accelerate

- Notice of Acceleration

- Maturity Protest

- Notice of Protest

- Foreclosure Notices that can be waived by law

- Anti-Deficiency Statutes

- Estoppel Certificates

- Loan Servicing Company reports

- Borrower Payment History Report

- Payoff Report (receive updated payoff before closing)

- Dodd Frank compliance

- Borrower credit report (if provided)

- LexisNexis Riskview Liens & Judgements Report (if provided)

- Assignments and allonges

- Clear chain of assignment

- Assignments recorded in chronological order

- Legal

- Assumption of legal fees

- Judicial vs. non-judicial foreclosure state (check with this free resource)

- Pre-foreclosure

- Active foreclosure

- Active bankruptcy

- Previous bankruptcy

Property

Key Differentiator Between Real Estate and Notes

A key differentiator in real estate note investing is that you are not able to perform any type of interior inspection of the note’s underlying collateral. You cannot simply knock on the borrower’s front door and ask to inspect their property. Think about it, would you let a total stranger into your home to inspect your property for some unknown reason. In fact you cannot legally contact a borrower who is paying on a note that you are looking to purchase.

This differentiator is often completely overlooked by new note investors who were previously fix-n-flip investors. This results in fix-n-flippers overpaying for notes, and quickly getting burned in the note investing space. To account for this differentiator, note investors must build a larger discount into their note offers. The larger discount will help offset interior repairs if the property is ultimately taken over by the note investor. Remember to factor this into your note investing due diligence and ROI calculator.

City Data Points

While some real estate note investors only invest in their local backyards, the majority of them invest across the United States. This ability to invest throughout the United States is an attractive aspect of note investing. As part of your note due diligence you should analyze the local city data analytics to determine the value of the underlying property. For example if you purchased a note with the underlying collateral in a rural area, you will have a much harder time trying to ultimately exit the note.

Basic City Data Points

- City population

- Historical and current population growth

- Surrounding area populations (e.g. the note could be in a rural town, but could be a few miles away from a major city)

- Historical and current vacancy rate

Additional City Data Points

- Proximity of closest regional airport

- Local job growth

- Local job industries

- Rent vs. ownership rates (e.g. if 75% of the city are renters, you could have trouble renting the property out if you take it over)

Where to Pull City Data?

While there are multiple websites that track this information, 2 of the more common websites are usa.com or the United States Census Bureau. The United States Census Bureau performs their nationwide census every 10-years, the last of which was performed in 2010. Additionally, you can glean valuable information from local real estate agents or landlords that have rentals in the area you are looking to invest in.

Basic Property Data Points

As you continue to develop your craft as a note investor, you will fine tune your filters with regards to analyzing a property associated with a potential note investment. That being said, here is some of the basic information to consider and set your investment thresholds for during your note investing due diligence:

- Square footage

- # of beds/baths

- Year built

- Lot size

- Type of structure

- Type of property (e.g. townhouse, Single-Family Residential (SFR), multi-family)

- House type (e.g. ranch, rambler, colonial, split-level)

- # of stories

Additional Property Data Points

- Crime Rate -> Pull crime rate data from Trulia (light blue = low crime, dark blue = stay away)

- Flood Zone -> Check by going to Federal Emergency Management Agency (FEMA) Flood Map Service Center

- Rent Rate -> Use Rentometer, Trulia, Zillow, a local real estate agent, or see what properties are renting for on Craigslist

- Local School Ratings -> Use Trulia which pulls school rating information from GreatSchools

Get Eyes on the Property

It is crucial to get eyes on the property during your due diligence. At the end of the day if the collateral turns out to be a blighted property that is in disrepair, it will be harder to recover your initial note investment, let alone attempt to make a return. There are many ways to get eyes on the property, all with varying degrees of confidence. Here are a few of them:

- Use Google Maps or Bing Maps to get a satellite view and street view of the property (make sure to check when these pictures were last taken)

- Have someone do a drive-by of the property

Pull a BPO or CMA

One of the members of your team in every market that you are note investing is a local real estate agent. They have the knowledge that can help tremendously with accurately valuing the local real estate. Usually you can gauge fairly well what the market price of a property is through running comparable sales on sites like Trulia or Zillow. However this can become more difficult if you are investing in areas like Texas, which does not publish the sales prices of properties.

Restrictions like those found in Texas are one of the reasons why you may want to have a local real estate agent pull a Comparable Market Analysis (CMA) or a Brokers Price Opinion (BPO). The main difference in the 2 is that a CMA goes into greater detail on comparable properties that recently sold in the area, which is how the real estate agent derives the estimated value of the property. As far as the prices go for these, you are usually looking anywhere from $50 to $150, it varies by market.

Valuation is in the Eye of the Beholder

Keep in mind that every real estate agent has different perspectives and experiences that they bring to the table. That being said, it may be a good idea to have another real estate agent give you a rough value of the property. It never hurts to have a 2nd opinion, especially if your research on the property value doesn’t line up with what your real estate agent is telling you.

In addition, it is a good idea to have several real estate agents that you can go to in the local market in case your main real estate agent is out on vacation or has a family emergency.

Get a Sense of Potential Repair Costs

While you can have a real estate agent give you an estimate to the repairs, I prefer to have a local housing contractor or general contractor drive-by the house, perform a visual inspection of the property and give me his opinion of the overall repair costs.

Make sure to be totally transparent when you are talking to your contractor, so he knows that you don’t own the house and that he can only do an exterior assessment and estimate right now. You can also hit 2 birds with 1 stone because your contractor can take photos of the property for you at the same time.

Quick Rule of Thumb for Rehab Costs

You can use this quick rule of thumb when it comes to rehab costs, based on the overall condition of the property:

- Light -> $10/square foot

- Medium -> $15/square foot

- Heavy -> $20/square foot

So if you had a 1300 square foot house that is in average condition, you may only have light rehab costs. Using the rule of thumb above, you can do a high-level estimate that you’ll spend $10/square foot, or $13,000 to get the property rehabbed.

Next let’s spend some time talking about the next area of note investing due diligence: tax, title and liens.

Tax, Title & Liens

O&E Report

After your initial bid is accepted on an asset, one of the first steps that should be taken in your note investing due diligence is to order an Owner & Encumbrance (O&E) Report from a title search company such as ProTitle USA . An O&E Report is a key tool that is used by note investors to assist in their due diligence process. I exclusively use Protitle USA with my note investing, have spoken to the owner of the company, Alex Goldovsky, on several occasions and would recommend using their services in your note investing businesses. As far as cost goes, an O&E Report costs $87.95 from ProTitle USA, it is well worth the money.

Generally with an O&E Report you are going to receive a comprehensive report detailing the results of the following informational searches:

- Vesting information

- Mortgage and assignments

- Federal, state and municipal liens

- HOA lien

- Civil judgements

- Foreclosure proceedings

- Tax delinquency status

- Property information (e.g. property address, parcel ID, legal description)

- Current owner deed

Once you have received the O&E Report, you want to leverage it throughout your secondary note investing due diligence. Specifically you want to use the O&E Report to determine the following information.

Taxes

Review the O&E Report for county property tax delinquencies, and call the County Treasurer’s Office to confirm that property taxes are current. Also ask the county who the last person was that paid the property taxes, since sometimes the lender paid the property taxes in order to prevent a county tax sale. Additionally, take the time to ask the county if they will provide the mailing address of the person who paid the property taxes. This will help you determine if the property is owner occupied, and is a crucial area of note investing due diligence that cannot be ignored.

Tax Lien States vs. Tax Deed States

In a tax lien state, delinquent property taxes are sold to the highest bidder at public auction in the form of a tax lien certificate. In contrast, when a tax deed is won by a buyer, they are actually purchasing the property, effectively owning the real estate free and clear. There are numerous intricacies that play into tax liens and tax deeds, which are out of the scope of this article.

During your note investing due diligence process you may find that the property is scheduled to be sold at tax sale due to unpaid property taxes. If the taxes are current, a property tax lien could have been sold to another investor, which means that you may have to ultimately satisfy the tax lien certificate attached to the property. Take the time to ask the County if a tax lien certificate was recently sold for the property.

Liens & Lien Positions

Confirm the lien position of the note, if it is a first position lien it should be listed at the top of any other liens that are attached to the property. So if you are purchasing a note that the seller says is a 1st position note, but there is another mortgage/deed of trust that is in 1st position on the O&E Report, you have cause for concern.

Additionally review all other liens and judgements that are listed on the O&E Report and pay particular attention to the recording dates for the liens. Lien priority is determined by the recording date of the subject lien. Remember to factor all of the liens when determining your exit strategy. Liens and judgements will cloud the title of the property, and must either be satisfied or stripped through a legal action, such as foreclosure, in order to remove them from title.

Don’t forget to double-check if you are investing in a superior lien state during your note investing due diligence. What is a superior lien state you ask?

Superior Lien States

What are Superior Liens?

A superior lien state is a state in which Home Owner Association (HOA) and Condominium Association (COA) liens automatically are placed in 1st position and must be paid back first in the event of foreclosure. What’s worse is that in some states HOAs and/or COAs can foreclose on a property in order to satisfy the super liens that they have placed on properties. These liens are known as super liens and should be accounted for in your due diligence process. There is a very informative paper written by Hugh Lewis that can be found here, which talks about Superior Lien States.

Superior Lien States

From my research I found that the following states have super liens:

- Alabama

- Alaska

- Colorado

- Connecticut

- Delaware

- Florida

- Hawaii

- Illinois

- Maryland

- Massachusetts

- Minnesota

- Missouri

- Nevada

- New Hampshire

- New Jersey

- Oregon

- Pennsylvania

- Rhode Island

- Tennessee

- Vermont

- Washington

- West Virginia.

Superior Lien States Interactive Map

To view an interactive map of all superior lien states and their respective statutes regarding HOA and/or COA superior liens, visit NoteVestment.com’s resource page here. If you are purchasing a note with significant super liens attached to the property, I would advise that you speak with an attorney specialized in that state’s laws. Every state works a little differently, so it is good to have a local attorney as part of your team.

Water, Sewer and Utility Liens

Municipal liens will show on the O&E Report, but it is always a good idea to also call the local water and utility companies to make sure that all accounts are current for the property. Depending on the area you are investing, you may have to satisfy any outstanding utility balances if you ultimately take over the property.

You also want to call the utility companies to see if any of the utilities are shutoff, which would be a clear indicator that the property is vacant. Based on your investment strategy, you may or may not want to pursue a property that is vacant.

The next piece of information to review during your note investing due diligence is potential county code enforcement violations.

County Code Enforcement

You want to check with the county of any current code enforcement violations such as lawn maintenance or other deferred maintenance that can be assessed fines by the county. You might think that this is trivial, but some counties have huge fines associated with their code enforcement, to the tune of thousands of dollars. For example, in Lorain County, OH there is $200 fee that is assessed if the county has to go out and cut the grass on the property. Check with the county to make sure the property doesn’t have code enforcement violations. If there are violations, check to see if they can be reduced and how they need to be paid.

Collateral Review

After winning the initial bid on an asset, you will receive a package of soft copy collateral files to review as part of your secondary note investing due diligence. Note that once you purchase the note, the seller will send you the hard copy collateral files.

The collateral files should contain the following documentation:

- Mortgage / Deed of Trust

- Riders (e.g. Adjustable Rate Rider)

- Note and Note Addendums

- Title Policy

- Final HUD-1

- Potential Loan Modification Agreements

- Allonges to Note

- Assignments of Mortgage / Deed of Trust

- Loan Servicing Notes

- Borrower Credit Reports

- Other Pertinent Documentation (e.g. Error and Omissions / Compliance Agreement, Borrower’s Driver’s License)

Hire Out Your Collateral Review

Attorneys as well as companies like Richmond Monroe provide collateral review services to note investors. While I personally haven’t used Richmond Monroe’s services, they provide piece of mind to note investors. Having a professional company review your collateral files can give not only you, but your potential investors the peace of mind to move forward with note acquisitions. In addition to collateral review, Richmond Monroe provides a wide-range of services like document storage and recording services. Now let’s talk more about the areas of collateral review that should to be performed.

Notary License in Good Standing

An often overlooked point in note investing due diligence is to make sure that all notarized documents, such as the mortgage or deed of trust has been notarized by a notary with a valid license at the time of notarization. If the notary’s license was expired when the document was notarized, it could lead to issues later down the road for you as the new lender. Review the notary’s stamp on all notarized documents to ensure that their notary license was current at the time of the notarization.

Mortgage / Deed of Trust

While most mortgages and deeds of trust look very similar, it is good practice to perform a cursory review of these documents during your note investing due diligence. You want to continue to gain familiarity with their structure, language and application. Added to the fact that each state can operate differently, it is good practice to review the mortgage and deed of trust, even though it can feel tedious and repetitive. Items to check-off as you perform your cursory review are:

- Due on Sale Clause

- Language on Lender Recourse Provisions

- Signed by Borrower

- Notarized by a Notary Public in Good Standing

- Language Requiring Insurance on Property

- Language Requiring Borrower to Pay Taxes Accrued and Due

- Late Charge Provisions

- Foreclosure Procedures

- Accurate Legal Description with Property Lot and Block

Also, double-check that the mortgage or deed of trust is fee simple rather than lease hold or fee simple conditional. You want to be sure that you aren’t purchasing anything other than a fee simple mortgage or deed of trust, because it means that the property is owned outright with no other third-party ownership. In a fee simple conditional, the mortgage can conditionally become fee simple if all conditions have been met first. Stick to fee simple mortgages or deeds of trust.

Note and Note Addendums

Verify Note Information

During your note investing due diligence review the original note to verify that it was signed by the current borrower. If the original note is missing, then you will have to get a Loan Loss Affidavit in place of the original note. Your options at this point would be to walk-away from the deal, request the seller to furnish the Loan Loss Affidavit or substantially fade your offer price on the note to account for the missing note documentation.

Basic Note Information

The note should contain the following basic information, which is good practice to perform a cursory review of and compare to the information the note seller has provided you:

- Note Terms (e.g. Total Amount, Payment Amount, Origination Date, Maturity Date, Loan Term/Length, Interest Rate Before Default, Interest Rate After Default)

- Borrower’s Address

- Lender’s Address

- How payments will be applied?

- Late payment provisions

- Usury Savings Clause

Waiver Provisions

You will also see that the note usually has the following waiver provisions:

- Notice

- Demand

- Notice of Intent to Accelerate

- Notice of Acceleration

- Maturity Protest

- Notice of Protest

- Foreclosure Notices that can be waived by law

- Anti-Deficiency Statutes

Estoppel Certificates

On top of this basic information you want to look for estoppel certificates with the note, which are legal signed documents between the mortgagee and mortgagor such as the Unpaid Principal Balance (UPB) or interest rate of the note. Estoppel certificates are usually used so that a signing party cannot later contradict the agreed to facts at some point in the future. Lastly look for Loan Modification Agreements or revisions to the Note, which may impact your bid price.

Servicing Company Reports

As part of your note investing due diligence ask the note seller to provide you with a Borrower Payment History Report and a Payoff Report from their loan servicing company. It is important that the report is created by the Loan Servicing Company so that you are working with unbiased data. On the Borrower Payment History Report, review the pay history of the borrower and review the other data points that should be provided on this report, such as the current Unpaid Principal Balance (UPB), interest rate and maturity date. You are looking for any indicators that are out of place, and don’t line up with the note seller’s tape that they provided you for review. For example, if the UPB is $15,000 less than was originally advertised by

On the Payoff Report, verify that the Payoff Report was run within the last several days. This is important because you want to see if the borrower has recently made a large payment on the note, which you could be entitled to based on the terms of the Loan Sale Agreement (LSA) that you sign with the note seller. A large payment could also be cause for a fade on your offer price. Again this is an important step to have this Payoff Report pulled as close to your note purchase as possible.

Now don’t forget to check for Dodd Frank Compliance.

Dodd Frank Compliance

If the note was originated after January 1st, 2014, review the note to ensure that it is compliant with Dodd Frank. Based on the loan originator and the number of seller financed notes they originated in the past 12-months, the following restrictions/regulations may apply:

- The loan may not be for a residential property in which the borrower currently resides

- A balloon payment may be prohibited

- Specific rate adjustment limitations and maximum interest rate adjustments apply to Adjustable Rate Mortgages (ARMs)

- An ability to pay may need to be evaluated against the borrower before the loan can be originated

The regulations surrounding Dodd Frank go beyond the scope of this post. However we wrote a great post about Dodd Frank and its affect on real estate note investing, which goes into the specifics about the different categories of note originators, and some recommendations on how to navigate the new Dodd Frank waters. If you’re interested, you can take a look through that post here.

Credit Report Review

In some collateral file packages you will get a new credit report for the borrower, or a credit report that was created when the note was first originated. You can glean a ton of great information about the borrower just by reviewing the credit report, and it is a great bonus document for your note investing due diligence. One of the ways to utilize a credit report is in assessing future loan defaults based on the cumulative amount of outstanding debts the borrower currently owes. For example, if a borrower owes $100,000 in credit card debt and they have been missing some of their mortgage payments, you are looking at someone that may pursue bankruptcy or could be difficult to come up with a viable loan modification. It is good practice to review these credit reports and use them as a tool for analyzing your potential exit strategies.

Credit Reports DO NOT Show Current Judgements

Many of you may not be aware of a huge change in the way that credit is being reported, a change that affects almost 20-million people across the United States! As of July 1st, 2018 the majority of all tax liens and civil judgements will not show up on a borrower’s credit report. As a matter of fact, it has been estimated by the 3 main credit bureaus (Equifax, Experian and TransUnion) that over 50% of all tax liens and over 95% of all civil judgements have been wiped off of credit reports.

This is huge news for real estate note investors, especially for 2nd position lien note investors, who use credit reports extensively when performing due diligence. Make a mental note that credit reports provide a piece of the puzzle when you are looking at a borrower’s outstanding debts and liabilities. So how do we work around these changes to credit reporting?

O&E Reports Civil Judgements & Tax Liens

Go back to your O&E Report, it will have any information on civil judgements and tax liens. It is a good idea to review the 1st few O&E Reports that you order with the company that produced the report. Not only will you gain some great knowledge reviewing an O&E Report, but it should be a free service that is offered by the reviewing company who produced the O&E Report.

LexisNexis Riskview Liens & Judgements Report

As an aside, some note sellers and lenders are starting to offer LexisNexis RiskView Liens & Judgments Reports as part of their note investing due diligence collateral files. LexisNexis Risk Solutions, a large data aggregator, offers this report, which provides a complete listing of all of the borrower’s liens and judgements, which would otherwise be missing from a standard credit report.

Next you want to review all assignments and allonges.

Assignments and Allonges

What are Assignments and Allonges?

When an institutional lender, or note investor, purchases a mortgage or deed of trust (also known as a security instrument), the it is conveyed to the new lender through an Assignment of Mortgage or Assignment of Deed of Trust. The note is conveyed through an allonge, which is basically an endorsement to the new lender or mortgagor. Once a mortgage has been assigned with a note you start to build up a chain of assignments and corresponding note allonges.

Just to reiterate, the assignments and allonges are 2 distinct pieces of the collateral files that go hand in hand. You want a clear chain of assignment as well as a clear chain of allonges. Now let’s talk about looking for a clear chain of assignment during your note investing due diligence.

Clear Chain of Assignment

For a clear chain of assignment, there should be a distinct and definitive linkage from the originator of the note all the way to the current mortgagor, or lender, of the note. You could think of it almost like an electrical circuit, where a break in the wiring results in a short.

Review the Assignment of Mortgage or Assignments of Deed of Trust as well as the note allonges to ensure that there are no breaks in either of the chains. If there is a break, you need to go back to the note seller to see how they can remedy the situation. Also make sure to review the recording dates for the Assignment of Mortgages, they must be recorded in order at the county from oldest to newest. Just like Assignment of Mortgages, for the allonges you want to see a clear chain of allonges from the original of the note to the current mortgagor.

As an aside, note allonges are addendums to the original note, and are not recorded in the county, just like the original note, which isn’t recorded either. Now let’s say as you’re performing your note investing due diligence you find that the Assignments of Mortgage aren’t recorded with the county, the mortgage could be held in MERS. So what is MERS?

Mortgage Electronic Registration System, Inc. (MERS)

MERS was created back in the 1990’s to help banks and financial institutions quickly buy and sell mortgages. With MERS, a Mortgagee doesn’t have to record an Assignment of Mortgage each time the mortgage is sold to a new lender. You will know that a mortgage is recorded in MERS if you see a long, 18-digit number near the top of the mortgage or deed of trust paperwork. This is called the MIN or MERS Identification Number. If a mortgage is registered in MERS, it can be sold multiple times without having to record any of the Assignment of Mortgages.

If you are curious, you can use this free tool lookup the current loan servicer and note holder on MERS’ website.

Help Me Remember Mortgagee vs. Mortgagor?

Since it can get confusing talking about mortgagees and mortgagors, here is a quick tip to help you keep the 2 straight. I always go back to the words employer and employee, which are familiar terms for everyone. Now, I know that employer isn’t spelled employor, so start with employee when using this memorization tool. An employee gets a job from an employer, just like a mortgagee gets a mortgage from a mortgagor.

This works the same with other common real estate terms such as grantee and grantor, or lessee and lessor. Keep this in mind as you’re reviewing the collateral files.

Legal

Having great attorneys, both foreclosure and bankruptcy, as part of your teams throughout the country is invaluable. Especially as you are starting out as a note investor, spend the extra money and hire a professional who will perform note investing due diligence properly. Most importantly, once your attorney reviews everything, have them walk you through the process that they took as they went through their due diligence process. You want to learn as much as you can from these attorneys so that you will become more and more familiar with legal due diligence with note investing.

Pre-Foreclosure or Foreclosure

You want to take a look at the O&E Report, which will list any foreclosures that are either pending or have already begun. The O&E Report may have the phrase, Lis Pendens, which is latin for “a suit pending” and is your indicator that you could be dealing with a foreclosure situation. If you see the phrase Notice of Substitute Trustee that is when the foreclosure has been initiated by the lender. The O&E Report will also have a reference number listed, which you want to use to look further into the status of the foreclosure.

At this point you should engage with your foreclosure attorney and have them perform a quick review of the status of the foreclosure. If the foreclosure is close to completed, you may be able to assume the role as the new lender and complete the foreclosure process. This is based on state laws, so you would need to consult with your foreclosure attorney on specifics.

All said, a foreclosure could be very good for your note investing business, it all depends on the strategy that you are ultimately pursuing. If you are looking to acquire properties through notes, you may want to target notes that are currently in foreclosure.

Non-Judicial vs. Judicial Foreclosures

In the process of your note investing due diligence, make a note if you are investing in a non-judicial or judicial foreclosure state. State law dictates the type and length of foreclosure in their state. Judicial foreclosures are going to be much longer and will be more expensive than a non-judicial foreclosure. Don’t underestimate the cost of foreclosure when you are punching all of your financial figures into your Return On Investment (ROI) calculator. On top of the legal costs associated with foreclosure, you must also pay for numerous administrative fees (e.g. court fees, publication fees, auctioneer fees), which can account for 40% of the total foreclosure cost.

Knowing a state’s foreclosure process is a piece of your due diligence, you may write-off a state completely because of the lengthy and costly foreclosure you would incur. For example, many note investors don’t even consider purchasing properties in New York or New Jersey because of the lengthy foreclosure timelines they would be facing if the properties must go to foreclosure.

Fannie Mae publishes allowable foreclosure attorney fees on their website, you can review this fee breakdown across all 50 states here. Remember that attorney fees is just part of the equation for foreclosure fees.

Interactive Map of Judicial and Non-Judicial Foreclosure States

Recently we published a blog post showing the breakdown of judicial and non-judicial foreclosure states across the United States. In this post is an interactive map showing all of the states as well as direct links to each state’s latest foreclosure statutes. You can check out the interactive map here.

Non-Judicial Foreclosure Redemption Periods

The majority of all non-judicial foreclosure states, have a redemption period, that must be observed after a foreclosure sale. Different factors that play into the length of a foreclosure redemption period. For example, in some states if the lender is pursuing a deficiency judgement on the borrower, the redemption period may change. Consult with your foreclosure attorney on specifics relating to state law’s surrounding foreclosures in the relevant states that you choose to invest in. When building out your foreclosure time frames and calculating your ROI, make sure to factor in the holding costs associated with the redemption period in non-judicial foreclosure states.

Assumable Legal Fees

This is important, make sure that you thoroughly review the sales agreement that you sign with the note seller. Double-check that you are NOT subject to assumable legal fees. Note sellers may have an assumption of legal fees built into their contract, which means you would be on the hook for any associated legal fees. If the note seller wants you to assume a backlog of legal fees with the idea that you will recoup all of the costs at foreclosure, adjust your bid price, or fade your bid appropriately. Either way, double-check for this before signing the sales agreement.

Bankruptcy

Similar to pre-foreclosure or foreclosure actions, it is a good idea to hire a bankruptcy attorney that practices specifically in the state that you are purchasing your real estate backed notes. There are so many intricacies that can play out with a bankruptcy, that it is a good idea to hire an attorney to review a bankruptcy during your note investing due diligence.

Quick Points on Bankruptcy

- Chapter 13 and Chapter 7 Bankruptcy are the main types of bankruptcy you will see in note investing

- Bankruptcy does not eliminate debt, it eliminates the obligation to pay debt.

- Automatic Stay is an automatic injunction that stops any creditor from proceeding with debt collecting actions

- Chapter 13: Arrearage account will be paid on a monthly basis (not all at once)

- Bankruptcy Discharged = Approved

- Bankruptcy Dismissed = Rejected

Use PACER to Look Up Bankruptcy Information

PACER stands for the Public Access to Court Electronic Records and can be used to look up case and docket information on the status of bankruptcies across the United States. The cost to review records comes at the affordable price of $.10 cents per page. As you become more familiar with real estate note investing, I would highly recommend jumping deeper into PACER and learning how to use this amazing resource.

Bankruptcy Could be Good

A final thought on bankruptcy. The word carries a negative connotation, and is a data point that some investors completely avoid as part of their note investing strategy. However other investors prefer to invest in notes with borrowers in bankruptcy. For example, with a Chapter 13 bankruptcy a court appointed Trustee makes monthly payments, according to the bankruptcy payment plan, directly to the creditors. These payment plans force the borrower to make agreed upon payments, else have their bankruptcy dismissed.

Remember that you are investing in secured debt when you are investing in real estate backed notes. So you have the underlying collateral to fall back on. Unlike a credit card company that has unsecured debt, which they are attempting to collect on. With 1st position liens you are at the top of the list, in most cases, when it comes to getting your money back from the borrower. A quick side note, with 2nd position real estate backed notes, you are at the mercy of the 1st position note and may have your lien stripped in a Chapter 13 bankruptcy. We’ll save that for another post later.

Closing Thoughts

If you have gotten to the end of this article, I salute you! There is a ton of information and a lot of steps that go into note investing due diligence. I want to encourage you to continue to practice these due diligence steps so that you grow more familiar with each of the intricacies of each step. Things may feel slow at first, but you will get better, faster and more efficient at performing your note investing due diligence. Lastly don’t forget that note investing is a team sport, so remember to build and utilize your team of power players across the markets that you are investing in.

Just in case you missed Part 1 of The Basics series, What is Real Estate Note Investing?, you can read it here. Also if you want to sink your teeth into some good real estate note investing books, you can check out our real estate note investing book recommendations here.

As always, thanks for reading!

Disclosure Statement:

This article, also called a blog post, contains pertinent information and resource links to legal information, or information that may be construed as legal information, or guidance, aimed at helping the readers of NoteVestment.com with any number of aspects of real estate note investing. While I spend countless hours researching and sourcing the latest information pertaining to this article, or blog post, know that federal and state statutes are subject to change at anytime after the publication of this article, or blog post. I am not a licensed attorney and all information in this post should not be seen as legal advice. You should consult with a licensed attorney to obtain professional legal advice and perform your own due diligence before acting upon any of the information provided in this article, or blog post.